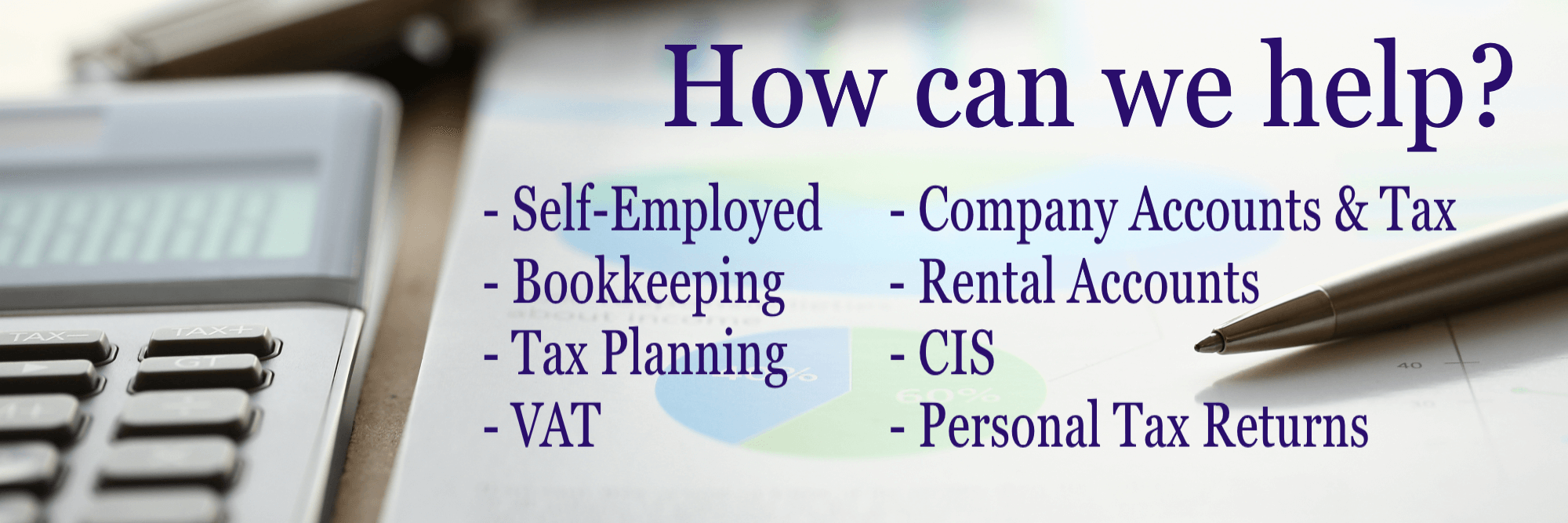

Welcome to Indigo Accounts. We are a small accountants in Fareham, providing a wide range of accountancy services to individuals and companies in Fareham and the surrounding areas. We pride ourselves on our individually tailored services and building close relationships with our clients, whilst offering expert guidance with vast experience in accountancy practice.![]()

Why Choose Us?

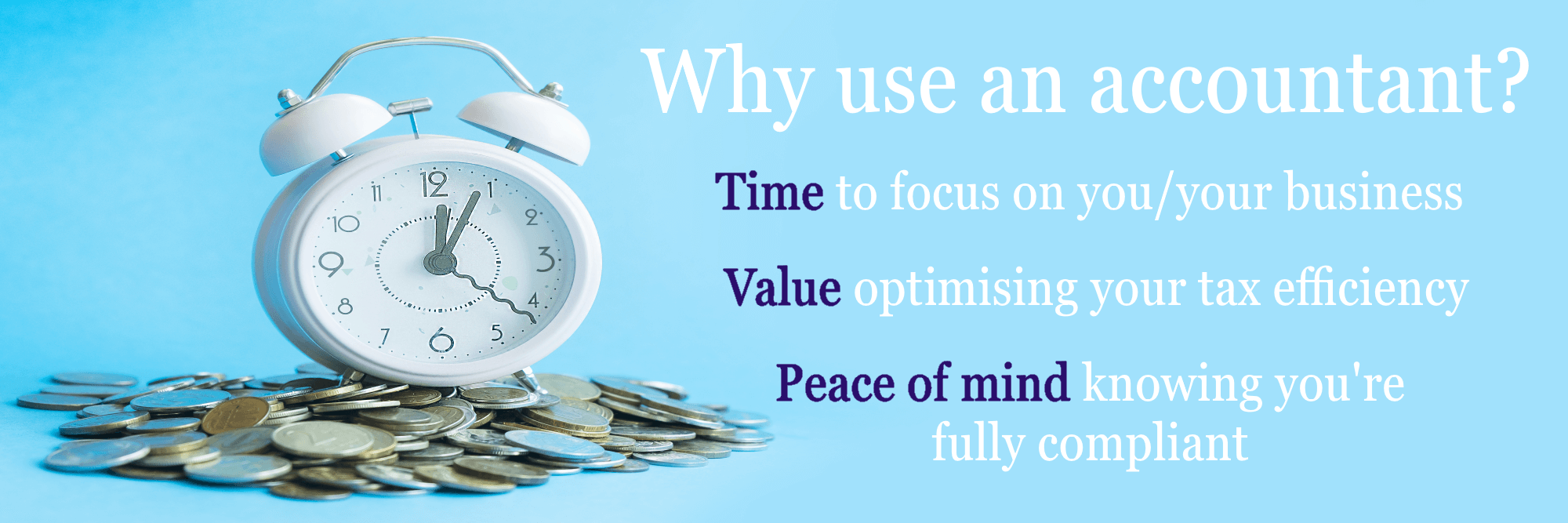

We're a small business, allowing us to give a personal service so you'll always be dealing with the same person. This promotes a close working relationship, tailored to your specific needs to find the most efficient solutions for you.

Find Out More...Personal Tax

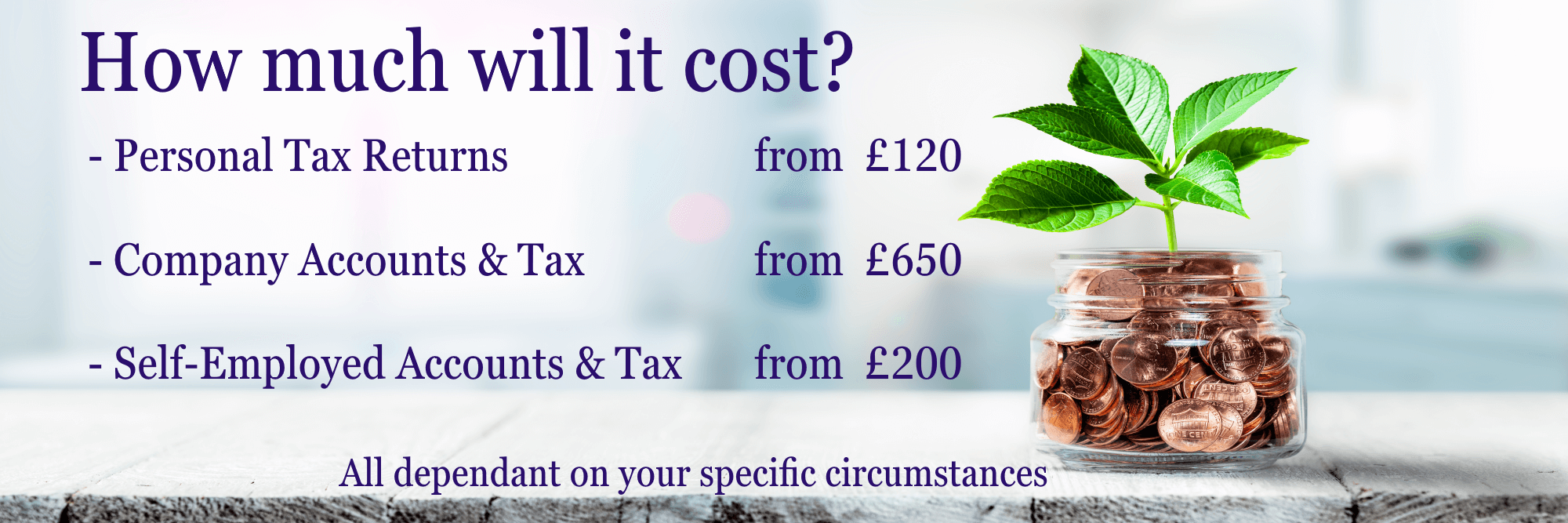

We're here to help you with your tax return whether you are just looking for someone else to take the burden away or your situation is more complicated with investments, properties etc.

Find Out More...Company Accounts & Tax

We help small to medium sized businesses with their accounts and tax. We know that as you build your business the last thing you want is to spend time on things like accounts, so we can take that burden from you whilst also adding our expertise to ensure that you have things setup in the most tax efficient manner to maximise your profits.

Find Out More...Sole Traders / Self-Employed

If you are self-employed we are here to assist you with preparation of your year end accounts and tax return. Helping you to optimise your tax efficiency.

Find Out More...Bookkeeping

Bookkeeping is a great way to keep on top of your income and expenditure on a regular basis and see the current position of your business. We offer a range of bookkeeping services, to suit various types and sizes of businesses.

Find Out More...VAT

We can calculate your VAT, prepare your returns and submit them to HMRC. Using our vast experience and knowledge, we can help take the stress away from you.

Find Out More...What our clients say

Lisa is a very good accountant who did my self assessment very quickly. She kept me informed at all times either by email or phone. Would definitely use her again. Her rates are very reasonable. She is a very competent accountant who deals with any issues in a professional manner. Thank you.

Lisa is a very good accountant who did my self assessment very quickly. She kept me informed at all times either by email or phone. Would definitely use her again. Her rates are very reasonable. She is a very competent accountant who deals with any issues in a professional manner. Thank you.

4th February 2021

Latest news

Companies House ID Verification

The Economic Crime and Corporate Transparency Act 2023 (ECCTA) is introducing identity verification requirements for directors, people with significant control, and individuals filing on behalf of UK companies. Who needs to verify? All directors, members, general partners and managing officers will need to verify their identities with Companies House. Also any PSC (Person with Significant […]Read More »

Tax changes announced for double-cab pick-ups

The Government have announced tax changes for double-cab pick-up trucks with a payload of 1.0t or more. They have confirmed that these vehicles will be treated as cars from 1st April 2025 for Corporation Tax and 6th April 2025 for Income Tax. This will apply for the purposes of capital allowances, benefits in kind and […]Read More »

Autumn 2024 Budget Summary

Autumn Budget 2024 Capital gains tax Inheritance tax Income tax Other changes for individuals Businesses Other points Disclaimer: This newsletter covers the key points from Budget 2024. It is not exhaustive and should not be read as a full fiscal summary. The content displayed is correct as of 30 October 2024. We cannot take responsibility […]Read More »